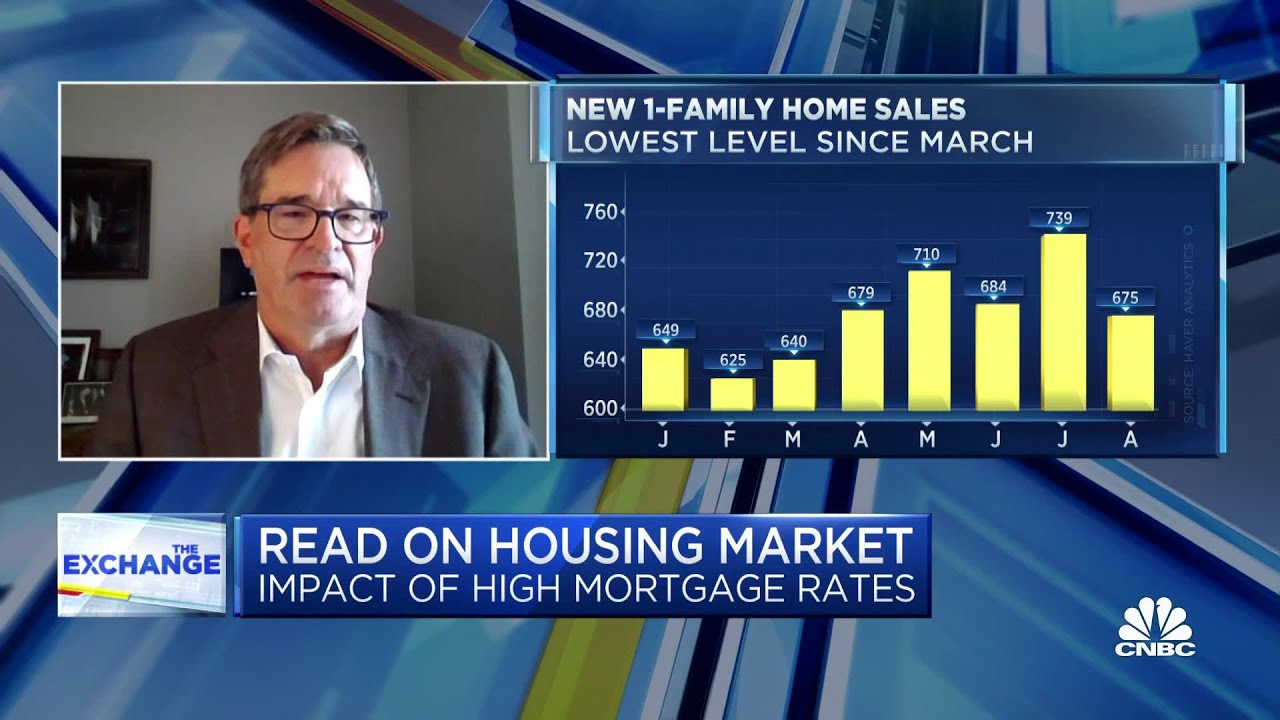

HIKE TO SEE AND NOT SELLING AT THE LEVELS, EITHER >> DIANA, WE APPRECIATE IT MY NEXT GUEST WARNS THE RECENT RISE IN MORTGAGE RATES WILL TEST THE RESILIENCY OF HOME SALES JOINING US NOW IS DOUGLAS DUNCAN WE ARE ALSO PLEASED TO BE JOINED BY DON PEEBLES, CHAIR AND CEO OF THE PEEBLES CORPS TO WEIGH IN. SO WELCOME TO YOU BOTH DOUG, I’LL START WITH YOU. I THINK IT’S IMPORTANT, ESPECIALLY FOR INVESTORS WHO HAVE BEEN FOCUSED ON THE STRENGTH OF THE HOME BUILDER INDECISION INDECISION THAT THE HOUSING MARKET IS QUITE SLOW >> IT’S A TOUGH MARKET IF YOU ARE A REALTOR OR MORTGAGE LENDER, YOU’RE FEELING LIKE THIS IS A SERIOUS RECESSION IF YOU THINK ABOUT IT, WE WENT FROM ABOUT 6 MILLION HOMES ON AN ANNUAL PACE DOWN TO A LITTLE OVER 4 MILLION HOMES THAT’S ROUGHLY A THIRD DROP IN THE BUSINESS IN YOUR INDUSTRY.

SO WHEN YOU PUT ON TOP OF THAT THE DISAPPEARANCE OF THE REFINANCE BUSINESS, IT’S FEELING REALLY ROUGH FOR THE MORTGAGE SPACE. >> RIGHT TO THAT POINT, IS THE QUESTION ABOUT WHETHER THE STRENGTH WE HAVE SEEN IN THE POCKETS OF HOME BUILDING AND THE STOCKS CAN CONTINUE, BECAUSE AS RATES GO HIGHER, IT’S ALL THE MORE IMPORTANT THEY CONTINUE TO DO BUY DOWNS TO MAKE THIS MORE AFFORDABLE >> WHAT’S UNUSUAL IN THIS ENVIRONMENT IS TYPICALLY, HOUSING IS, IF NOT THE MOST INTEREST RATE SENSITIVE, ONE OF THE MOST INTEREST RATE SENSITIVE SECTORS.

SO WHEN THE RATES RAISE, CONSTRUCTION SLOWS, FOLLOWED BY SALES ON THE WAY DOWN. IN THIS ENVIRONMENT, BECAUSE BOOMERS ARE DOING WHAT THEY SAID THEY WOULD DO, AGEING IN PLACE, AND GUZ THE GEN-XORS HAVE LOCKED IN 3% MORTGAGES, IT’S ON THE BACK OF BUILDERS TO INCREASE SUPPLIES SO IT’S BEEN A GOOD MARKET FOR THEM, SURPRISINGLY, EVEN THOUGH THE RATES ARE RISING THE DEMOGRAPHICS ARE IN THEIR FAVOR, AND THE SLOW SUPPLY SUGGESTS IT’S GOING TO BE THE BUILDERS THAT WILL BE ADDING TO SUPPLY AND TRYING TO EVENTUALLY EQUAL THINGS OUT BETWEEN BUYERS AND SELLERS.

>> SO DON, IF I MAY PUT IT LIKE THIS, WOULD YOU STILL BE BULLISH ON THE HOME BUILDERS, IN SPITE OF OR BECAUSE OF EVERYTHING WE HAVE SEEN, AND WHAT DO YOU THINK HAPPENS WITH RESIDENTIAL REAL ESTATE AT THIS POINT >> I THINK FUTURE IS STILL POSITIVE FOR HOME BUILDERS WHAT’S HAPPENED IS THE OVERALL FUNDAMENTAL OF REAL ESTATE OF SUPPLY AND DEMAND IS HOLDING STRONG ANYONE WHO WANTED TO BUY A HOME OR REFINANCE PRETTY MUCH HAD DONE IT BY THE TIME INTEREST RATES HAD MOVED UP SO YOU HAVE TO HAVE NEW BUYERS COMING IN. PEOPLE WHO ARE GOING TO TRADE UP OR NOT TRADING UP ANY MORE, BECAUSE THEY HAVE LOWER INTEREST RATES. BUT INCOME IS GOING UP, AND INTEREST RATES ARE GOING TO STABILIZE.

YOU’LL SEE THEM PULL BACK NEXT YEAR A LITTLE BIT, AND THERE WILL BE A SHORTAGE OF INVENTORY. MOST PEOPLE WHO HAVE AN INTEREST RATE OF 2.5%, 3.5% ARE NOT GOING TO SELL THEIR HOMES BECAUSE THERE’S A LOT OF VALUE IN THAT RATE >> ARE YOU BULLISH — YOU KNOW, WE KNOW THAT THERE’S AN APARTMENT GLUT IN A LOT OF THE COUNTRY THAT IS FORMING.

SO IS THAT AN AREA THAT IS ATTRACTIVE ON THE DEVELOPMENT SIDE OR NO >> IT DEPENDS ON WHERE IF IT’S NEW YORK CITY, NEW YORK CITY IS STILL SUPPLY CONSTRAINED.

THERE IS A SIGNIFICANT DEMAND FOR HOUSING. WHAT’S GOING TO HURT THE APARTMENT BUILDING SECTOR IS INTEREST RATES, ESPECIALLY ON EXISTING ASSETS THAT HAVE BEEN PURCHASED BASED ON PRIOR INTEREST RATES THAT HAVE BEEN BOUGHT AT 3.5% CAP RATES THOSE WILL HAVE A SIGNIFICANT AMOUNT OF STRESS AS INTEREST RATE SWAPS BURN OFF. AND THERE’S NOBODY TO REFINANCE WITH RIGHT NOW >> AND IF THEY CAN’T RAISE RENTS BECAUSE OF THE OTHER FACTORS GOING ON HERE.

DOUG, LET ME ASK YOU ABOUT ONE THING CREEPING INTO THE MARKET WE SPOKE WITH A COMPANY CALLED ROAM THAT IS TRYING TO MATCH PEOPLE WITH ASSUMABLE MORTGAGE WHEN YOU BUY THE PROPERTY, YOU CAN ASSUME THE LOWER MORTGAGE RATE THAT COMES WITH IT, AS WELL COULD SOMETHING LIKE THIS EVER GO MORE MAIN STREAM ACROSS MORTGAGES AND EXISTING HOMES OF ALMOST ALL TYPES >> THEY COULD, BUT IT’S DIFFICULT WHEN RATES CHANGE CAN BY A SIGNIFICANT AMOUNT IN A SHORT TIME PERIOD.

OF COURSE, YOU NEED TO MAKE THE MORTGAGE HOLDER WHOLE, GIVEN THE CHANGE IN MARKET RATES SO WHILE IT’S BEEN OUT THERE FOR A VERY LONG TIME, PARTICULARLY IN THE FHA CATEGORY, WE HAVEN’T SEEN A LOT OF ACTION IN THAT SPACE, SIMPLY BECAUSE THE RATE RISE WAS SO SIGNIFICANT AND SO SUDDEN >> SO IN OTHER WORDS, TO MAKE THEM WHOLE, THAT MEANS WHAT? >> IT MEANS IF THEY HAVE THE EXISTING MORTGAGE IS 3% AND THE MARKET RATE IS 6%, YOU’RE GOING TO HAVE TO MAKE UP SOM

Read More: Hawaii Housing Market Crash or Are We In a Bubble?